Understanding LSDfi: When Liquid Staking meets DeFi

LSD Finance (LSDfi) is a term used to refer to DeFi protocols that are related to and impact the realm of Liquid Staking Derivatives (LSD).

Hello everyone,

What is LSDfi? LSDfi has been one of the widely discussed trends recently after the Ethereum Shapella hard fork. Not only has it gained attention of many Key Opinion Leaders (KOLs), but the LSDfi projects have also shown significant growth in terms of TVL (Total Value Locked) and token prices.

So why is LSDfi so attractive? Let's explore this new term together! I'm Neo — Admin — Community Manager of Optimus Finance and Growth Marketing of LECLE Vietnam. Let's go!

1. What is LSD Finance (LSDfi)?

LSD Finance (LSDfi) is a term used to refer to DeFi protocols that are related to and impact the realm of Liquid Staking Derivatives (LSD). LSDfi provides opportunities for holders of LSD products to enhance profit-seeking capabilities and maximize the efficient utilization of capital.

2. LSDfi Ecosystem

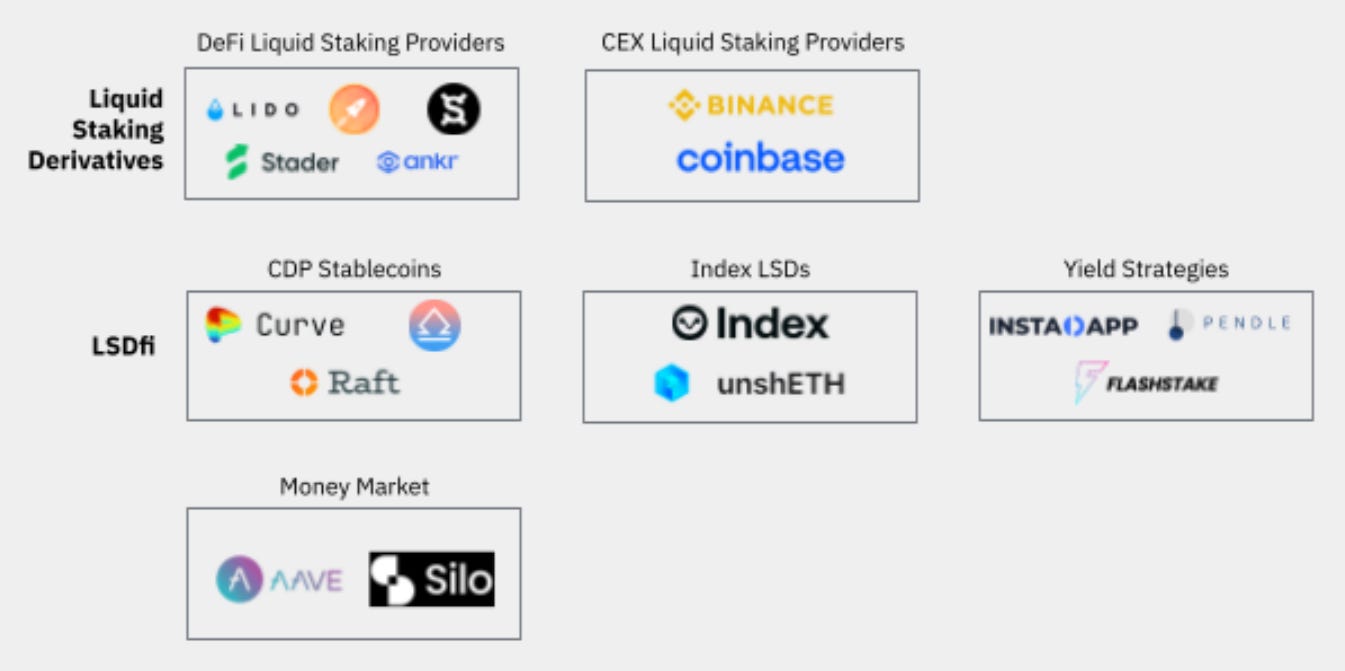

The LSDfi ecosystem includes a combination of mature DeFi protocols that have evolved over time and integrated LSDs to diversify their product offerings, as well as more recent projects that are predominantly built upon LSDs.

2.1. Liquid staking and LSDfi

DeFi liquid staking providers: DeFi protocols that enable users to participate in staking and receive LSDs as rewards.

CEX liquid staking providers: Centralized exchanges (CEXs) that offer liquid staking services.

CDP stablecoins: Collateral Debt Position (CDP) protocols that allow users to create stablecoins using LSDs as collateral.

Index LSDs: Tokens that represent a stake in a basket of LSDs. This approach allows for risk diversification and enables users to hold multiple tokens within the LSD ecosystem to maximize their asset returns.

Yield strategies: Protocols that enable users to access opportunities and strategies for increased yield on their owned assets.

Money market: Protocols that facilitate lending and borrowing activities using LSDs as collateral.

Market share percentage based on TVL of providers in the LSDfi ecosystem:

2.2. Overview of LSDfi projects

Lybra (TVL $161.6M) - The Lybra Protocol allows users to deposit ETH/stETH and mint an interest-bearing stablecoin (eUSD).

Instadapp (IETH) (TVL $54.5M) - Users can deposit ETH/stETH into a desired Instadapp vault that executes DeFi strategies and earns yield.

Pendle (TVL $46.6M) - Pendle is a yield-trading protocol enabling users to purchase assets at a discount or gain leveraged yield exposure.

Raft (TVL $45.9M) - Raft allows users to deposit stETH to generate R, a decentralized USD stablecoin.

unshETH (TVL $27.6M) - unshETH is a diversified liquid-staked ETH basket that earns staking ETH yield and swap fees, all wrapped in a single ERC-20 token.

Asymetrix (TVL $12.7M) - Asymetrix provides an asymmetric yield distribution generated from staking.

There is a wide variety of projects, from CDP stablecoins to automated yield strategies. With time, it is foreseeable that there will be more innovation in the space, benefitting LSD holders by providing more yield-generating options.

3. The Growth of LSDfi

LSDfi protocols have experienced a rapid increase in TVL over the past few months, benefiting from the adoption of liquid staking. As the narrative gained steam, cumulative TVL in top LSDfi protocols crossed the US$400M mark and has more than doubled since a month ago.

The growth of LSDfi protocols has benefited from the structural tailwind of an increase in staked ETH post-Shapella. With greater participation in staking, liquid staking adoption has also risen.

Naturally, holders of LSDs have also looked towards LSDfi protocols to generate additional yield. Such growth is unsurprising, considering there is over US$16.9B in LSDs on Ethereum and a TVL of only around US$412M in LSDfi protocols (~2% penetration).

4. LSDfi Outlook

4.1. Staked ETH growth

The staking ratio of ETH is currently at 16.1%, a level significantly lower than the average of 58.1% of the top 20 PoS chains.

Going forward, this gap should narrow as the enablement of withdrawals post-Shapella has increased the attractiveness of staking by allowing stakers to exit their position at any time.

If the staking ratio does increase, then the influx of staked ETH would serve as a positive catalyst and structural tailwind for LSD and LSDfi protocols.

Referring to on-chain data, there are already indications of heightened demand for ETH staking. The staking ratio has increased slightly from less than 15% pre-Shapella to more than 16% today, and more than 4.6M ETH has been staked since the Shapella upgrade.

Additionally, demand for staking is further evident from the current validation queue of 46 days. Any new validator wishing to enter the network and stake their ETH must wait 46 days.

4.2. LSDfi Penetration

While the adoption of LSDfi protocols (as measured by TVL) has increased, it is still a relatively small industry. Given that most projects have launched in the past couple of months, it is still early days for the industry. Nonetheless, as LSDs continue to gain traction and more holders look to generate yield, it would be unsurprising to see more innovation and project launches to capitalize on rising demand.

From another perspective, TVL in LSDfi protocols currently represents less than 3% of the total addressable market (using LSD market capitalization as a proxy). Admittedly, while some LSD holders may have reservations about using LSDfi protocols and it would be practically impossible to achieve 100% penetration, a low single-digit penetration represents large headroom for growth.

5. Risks

It is crucial to note that LSDfi is a relatively young market, and as with all emerging technologies, one should be aware of the risks involved in interacting with such projects. These include risks associated with liquid staking in general.

Slashing risks: Validators face penalties for failing to achieve certain staking parameters (e.g., going offline), and holders of LSDs may be exposed to these slashing risks.

LSD price risks: Prices of liquid staking tokens may fluctuate and differ from the underlying token due to market forces. This may expose users to price volatility and potential liquidation risks if used as collateral.

Smart contract risks: Every smart contract that a user interacts with presents new layers of smart contract vulnerabilities.

Third-party risks: Certain projects may utilize other DApps as part of their normal operations (e.g., yield strategies). In such cases, users are exposed to additional counterparty risks.

Additionally, the factors do not include project-specific risks that differ across projects. Users should conduct thorough due diligence before participating.

6. Closing thoughts

Liquid Staking Derivatives (LSDs) are a promising field with significant growth potential in the future, especially after the success of the Shapella hardfork. This is a necessary condition for bullish developments in branches stemming from LSD, such as LSDfi.

LSDfi protocols have opened up new opportunities for yield-seeking LSD holders. By providing additional use cases for liquid staking tokens,

LSDfi incentivizes staking participation and has the potential to accelerate the growth of liquid staking. Given that the sector is in its early stages of development, it will be exciting to observe further innovations in the space and to monitor the adoption of LSDfi.

However, this is a challenge that requires creativity in ideas and meticulous calculations in the economic model. Therefore, a solid long-term investment project in LSDfi is likely to require significant development time and a strong team behind it, rather than being a project launched hastily to capitalize on the LSD narrative FOMO.

What about your thoughts? If you want to know further about it, don’t hesitate to share it with us! 😀

This post is for educational purposes only. All materials I used were the different reference sources. Hope you like and follow us and feel free to reach out to us if there is an exchange of information. Cheers! 🍻

#LSDfi #LSD #Ethereum #cryptocurrency