What is Ethena (ENA)? A decentralized stablecoin issuance solution on Ethereum

Binance just introduced the 50th launchpool project, Ethena (ENA), a stablecoin platform on Ethereum.

Ethena project issues stablecoins without using traditional pegging methods like Tether's USDT. Additionally, Ethena's stablecoin utilizes Ethereum as its collateral asset. Let's explore what Ethena is. What makes Ethena's stablecoin, USDe, special?

1. What is Ethena?

Ethena, the 50th Binance Launchpool project, a stablecoin platform on Ethereum blockchain. The project's stablecoin is called USDe with the aim of providing an independent stablecoin solution outside the traditional banking system, along with creating a USD savings tool for global users built on derivatives. This project comprises two main components: the USDe stablecoin and the Internet Bond product.

2. USDe and Asset Backing Mechanism

2.1. USDe

USDe, the stablecoin of Ethena, is designed to provide a stablecoin solution that is stable and not controlled by central authorities. Through a process known as delta-hedging, Ethereum tokens back USDe.

Delta-hedging is a risk management strategy in derivative finance, aiming to balance the asset's position to minimize price volatility risk. In this case, Ethereum is used as the collateral asset, and USDe maintains its stable value through continuous adjustment of the delta position.

2.2. Delta-Hedging

Delta-Hedging, also known as Delta Neutral Trading Strategy, is used to generate income when the market lacks direction. While this is the definition, in reality, there are numerous methods to apply it, all with the common goal of mitigating price volatility and earning profits.

This means that the user's position remains unchanged during market fluctuations. When applied to the cryptocurrency market, the most commonly used investment method is to balance the user's overall investment portfolio to zero, creating a hedge, and earning profits from other methods such as IDOs, Airdrops, Staking, Farming, etc.

2.3. Internet Bond

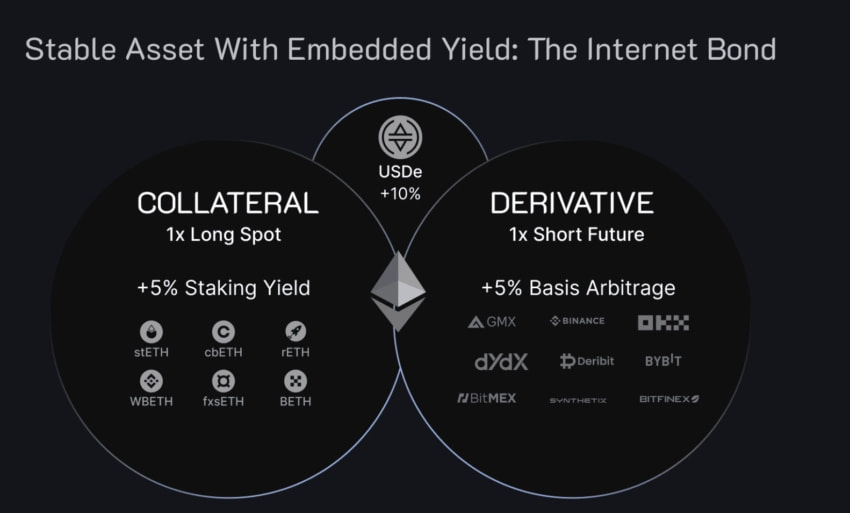

Internet Bond is a type of digital bond operating on the Ethereum blockchain platform. The Internet Bond helps USDe maintain a stable price by staking Ethereum and employing a dual-headed hedging strategy, ensuring that the price remains at $1.

To maintain the peg for USDe, Ethena Labs performs hedging by establishing offsetting positions in the derivative market or through other financial instruments.

For example, if users stake Ethereum to obtain USDe, Ethena will also open a 'short' position on Ethereum of equivalent value. This means they are betting on the price of Ethereum decreasing.

If the price of Ethereum rises, the value of the collateral asset (Ethereum) used to secure USDe increases, but the loss from the short position will offset this price increase. Conversely, if the price of Ethereum decreases, the loss from the decrease in the price of Ethereum will be offset by the profit from the short position.

In this way, any price fluctuations of Ethereum are balanced by the profit or loss from the hedging position, helping to maintain a stable value for USDe compared to USD. This condition allows USDe to maintain its pegged value, independent of market fluctuations.

3. What problem does USDe solve?

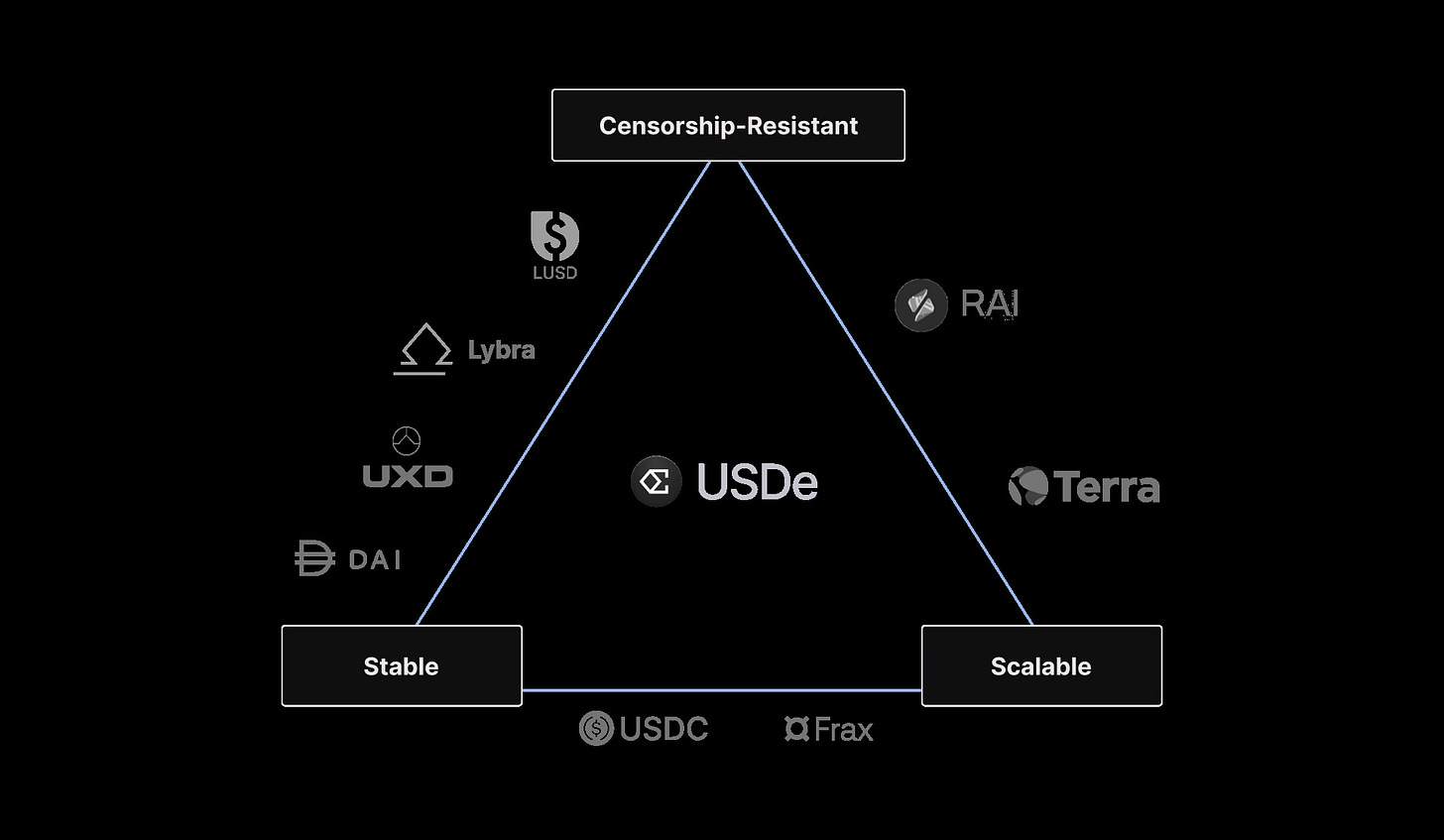

Centralized stablecoins like USDC and USDT rely on collateral assets managed by financial institutions and banks. This creates risks related to asset management and regulatory control. USDe addresses this issue by not relying on collateral assets within the traditional banking system.

Stablecoins backed by overcollateralization and algorithmic stablecoins struggle with scaling and maintaining stability. USDe addresses this issue by implementing a novel model, utilizing derivatives on Ethereum with hedging, to enhance scalability and stability without relying on traditional collateral assets or complex algorithmic mechanisms.

USDe aims to generate economic profit through the use of derivative structures on Ethereum, distributing profits to ecosystem participants. This differs from the model of other stablecoins, where profits are often internalized by the issuer without sharing them with users. The project aims to minimize reliance on trust in centralized entities and enhance decentralization by utilizing decentralized infrastructure for collateral asset maintenance and management.

4. USDe Mint Mechanism

Users deposit Liquid Staking Tokens (such as stETH, rETH) into the Ethena protocol to receive USDe. These tokens represent Ethereum that has been staked.

When minting or redeeming USDe, users incur slippage fees and transaction execution costs. These fees are factored into the total cost of the transaction.

After receiving Liquid Staking Tokens (LST) from users, Ethena Labs proceeds to open a short order on derivative exchanges. This order does not use leverage and has a value equivalent to the assets deposited by users into the protocol. The purpose of this is to hedge the price risk associated with the deposited assets.

5. How USDe earns profits and mitigates slippage

5.1. How USDe earns profits:

Staking Ethereum: Users earn profits from staking Ethereum, including inflationary rewards from the Consensus Layer, fees from the Execution Layer, and Miner Extractable Value (MEV) capture. These profits are paid out and denominated in ETH.

Funding and Basis Spread from Hedging Delta Positions in Derivative Trading: When USDe is minted, Ethena Labs opens short positions to hedge the delta of the received assets. Due to the imbalance between supply and demand for exposure to assets, there is often a positive interest rate and basis spread, one of which is the funding rate.

5.2. How USDe mitigates slippage:

USDe maintains its value equal to USD by automatically performing delta-neutral hedges through smart contracts for collateral assets. This ensures the stable synthetic USD value of collateral assets under all market conditions.

Cross Market Arbitrage: Users can take advantage of the price discrepancy of USDe between Ethena Labs and different markets to profit. When USDe is bought or sold at a price different from 1 USD, users can execute buy or sell trades to bring USDe back to the $1 price, thereby helping maintain the pegged value.

6. ENA Token Details

6.1. ENA Token Key Metrics

Token Name: Ethena

Ticker: ENA

Blockchain: Ethereum

Token Standard: ERC-20

Contract: 0x57e114B691Db790C35207b2e685D4A43181e6061

Total Supply: 15,000,000,000 ENA

6.2. ENA Token Allocation

Team: 30.0% (equivalent to 4,500,000,000 ENA)

Ecosystem: 28.0% (equivalent to 4,200,000,000 ENA)

Investors: 25.0% (equivalent to 3,750,000,000 ENA)

Foundation: 15.0% (equivalent to 2,250,000,000 ENA)

Binance Launchpool: 2.0% (equivalent to 300,000,000 ENA)

6.3. ENA token release schedule

6.4. ENA token sale

Binance Launchpool officially sold ENA tokens with a total pool of 300,000,000 ENA for 2 stake token pairs: BNB and FDUSD, on March 14, 2023.

Stake BNB: 240,000,000 ENA in rewards (80%)

Stake FDUSD: 60,000,000 ENA in rewards (20%)

7. Roadmap

2023 Q4: Ethena Pre-Launch (closed launch to investors) First $250m in USDe supply

2024 Q1: Ethena Public Launch February

2024 Q1: Shard Campaign Epoch 1 & 2 $150m Curve Liquidity, $1.5bn Uniswap volume, $250m Locked in Pendle, $400m USDe locked

2024 April 2nd: ENA Token Launch

Q2 2024:

+ ENA Token Launch

+ Exchange Listings

+ BTC Onboarded as Collateral

+ Beginning of Season 2 of Incentive Campaign

+ DAO governance rollout

Q3 2024:

+ SOL as collateral asset

+ USDe cross-chain initiatives

Q4 2024:

+ Conclusion of Season 2 of Incentive Campaign

+ Second ENA distribution after conclusion of incentive campaign

8. Project Team, Investors and Partners of ENA

8.1. Team

Guy Young: Founder

There isn't much information available about Guy Young, but prior to his involvement with Ethena, Guy Young worked at Cerberus Capital Management - a global investment fund with assets under management totaling up to $60 billion USD.

8.2. Investors

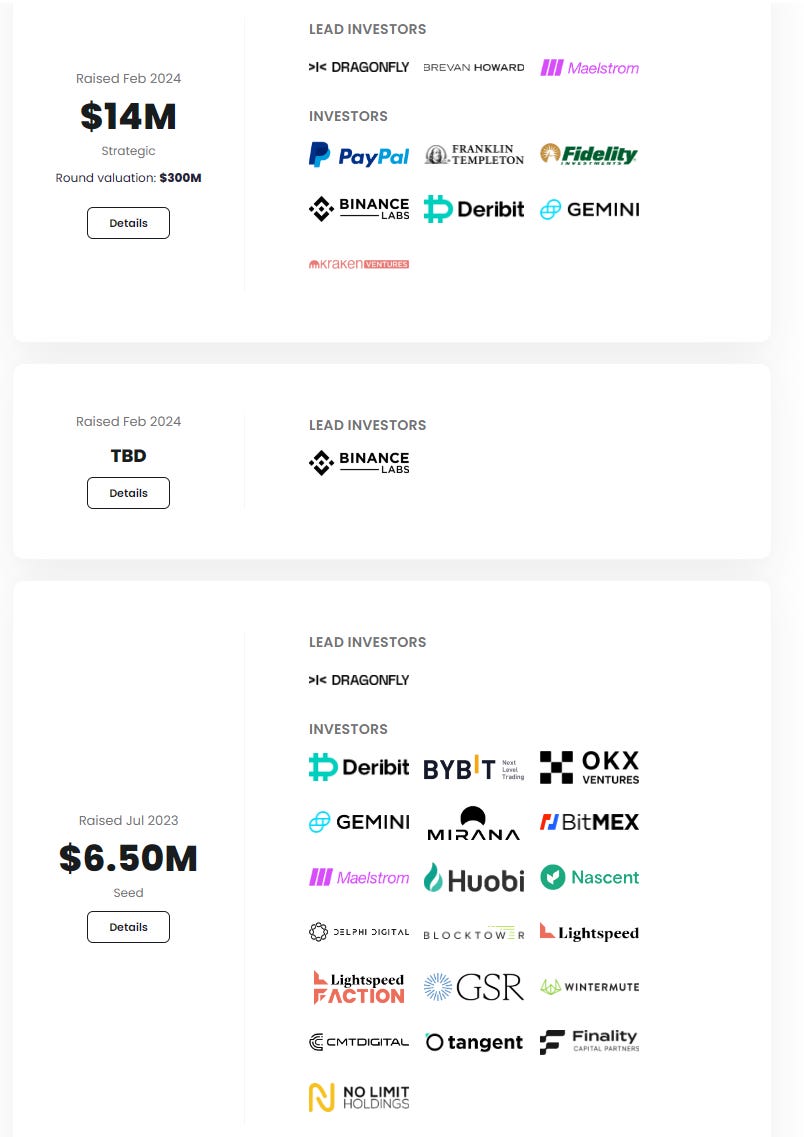

Ethena Labs has successfully raised $20.5 million in funding over the past year through two funding rounds. Notable investors such as Galaxy Digital, OKX, Dragonfly, Binance Labs, and Bybit, among others, participated in these rounds, leading to a valuation of $300 million for the token maker.

9. Closing thoughts

Ethena is a stablecoin issuance project based on the delta-neutral investment method. Within a short time of its product launch, the project has attracted over 103.1 thousand users, with over 1.398 billion USDe issued into the market. Through this article, you should now have some basic information about the project to make your own investment decisions.

What about your thoughts? If you want to know further about it, don’t hesitate to share it with us! 😀

This post is for educational purposes only. All materials I used were the different reference sources. Hope you like and follow us and feel free to reach out to us if there is an exchange of information. Cheers! 🍻

#Ethena #ENA #USDe #stablecoin #Ethereum #BinanceLaunchpool