What is Injective Protocol? Everything about Injective Protocol and the INJ token

Injective has grown into a blockchain with a large ecosystem, backed by top investors in the industry such as Binance, Pantera, and Hashed.

Launched in October 2020, Injective was initially known as a cross-chain protocol. However, since June 2021, Injective has developed into a blockchain with a sizable ecosystem and the support of leading business investors like Binance, Pantera, and Hashed. Let's explore what Injective is and the notable features of this project within the Cosmos ecosystem.

1. What is Injective Protocol?

Injective Protocol is a blockchain built for the finance industry. Injective is a blockchain within the Cosmos ecosystem, built on Cosmos SDK and the Tendermint Proof of Stake (PoS) mechanism of the Cosmos Hub network. It is an open, compatible Layer-1 blockchain designed for next-gen DeFi applications, including decentralized spot and derivative exchanges, prediction markets, lending protocols, and much more.

This platform provides infrastructure consisting of decentralized financial tools (exchanges, DeFi, and tools) for developers.

Injective also offers a next-gen smart contract platform with high compatibility based on CosmWasm. Injective is custom-built with Cosmos SDK and utilizes a Proof-of-Stake consensus mechanism based on Tendermint with lightning-fast performance (10,000+ TPS).

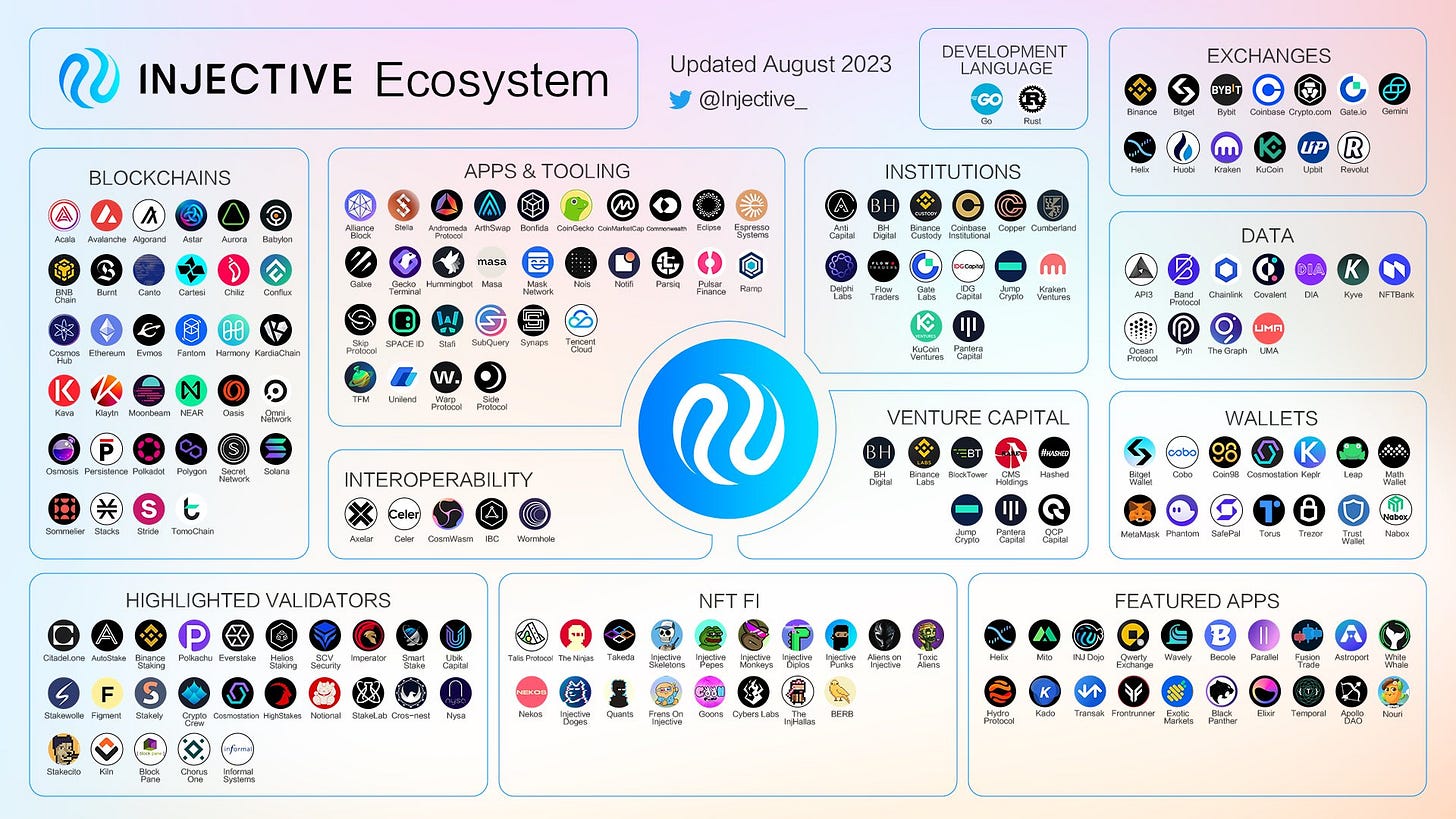

The Injective ecosystem comprises over 100 projects and more than 150,000 community members worldwide. Injective is backed by a group of renowned funds and investors such as Binance Labs, Pantera Capital, Jump Crypto, Mark Cuban...

2. Products of Injective

Injective Hub serves as the platform and gateway allowing users to interact with the Injective ecosystem. It is also the centralized location for compiling Injective's core products and features, including:

Wallet

Bridge

Staking

Governance

Burn Auction

Insurance Funds

Ninja Pass

Additionally, Injective supports developers in building DEX exchanges (orderbook, spot/futures). Some key technical components within Injective include chain nodes, bridge smart contracts, API nodes, dApps, and other tools.

2.1. Wallet

Injective Wallet is a crucial feature that enables users to connect with non-custodial wallets such as Metamask to create a wallet address on the Injective platform. Users can manage and track their assets through this Injective wallet address. There are two ways to create an Injective wallet:

Link an existing EVM wallet to create an Injective wallet.

Use wallets dedicated to the Cosmos ecosystem such as Keplr, using a standard passphrase.

It's important to note that:

Injective supports tracking and storing INJ (the native token of the platform), assets transferred from Ethereum, Moonbeam, and other chains supported by IBC. Each non-custodial wallet address will generate a unique Injective wallet address and there's no passphrase for recovery. To reuse an existing Injective wallet address, you need to reconnect the previously linked wallet.

From January 2021 to April 2023, the number of wallet addresses has significantly increased, surpassing 45,000, according to data from Dune Analytics. The INJ token has also seen active trading on decentralized exchanges (DEX) such as Uniswap, SushiSwap, and 1inch. You can find more information about transaction data, weekly/monthly user counts, and trading volumes of INJ on Injective's official sources.

2.2. Injective Bridge

The Injective Bridge is a tool that allows users to convert assets between different chains and INJ. This tool operates by transferring assets through Wormhole and then converting them into INJ on the Injective platform.

Currently, the Injective Bridge supports multiple blockchain chains such as Ethereum, Solana, Cosmos Hub, Osmosis, Evmos, Axelar, Moonbeam, Persistence, Secret Network, Stride, Crescent, and Sommelier. Before using the Injective Bridge, users should note the following:

To convert tokens, you need to have assets in your wallet and the native token of the chain you are using to pay transaction fees.

Transaction fees will vary depending on each chain, with Ethereum typically having the highest fees. You may choose chains with lower fees such as Solana or Evmos to save costs.

Although using the bridge is relatively straightforward, the transaction verification process may take some time, sometimes up to 20 minutes or more.

After conversion, tokens can be exchanged for INJ.

2.3. Staking

Injective Staking is the process where users delegate (stake) their INJ tokens into the system to participate in transaction validation through the Proof of Stake (PoS) consensus mechanism. By staking, users have the opportunity to earn rewards based on the amount of tokens staked and the duration of participation. These rewards are displayed in the Overview section of Injective Hub and can be withdrawn at any time.

During the staking process, users have the right to choose the validator they want to delegate their tokens to. It's important to select validators that operate efficiently and are trustworthy. Criteria for evaluating a validator include the amount of INJ they have staked, the commission fee they charge, and their voting power in the system.

As of now, there are a total of 154 validators on Injective, with 60 validators actively participating. The total amount of INJ tokens staked in the system is over 51 million tokens, with an Annual Percentage Rate (APR) of around 15%.

2.4. Governance

Governance in Injective is the mechanism that allows users to participate in managing and governing the platform. Governance activities include proposing, voting on proposals, as well as implementing upgrades and other ecosystem-related changes in Injective.

To create a new proposal, users select 'New Proposal' and choose the type of proposal they want to make (e.g., text, spot market, perpetual, or instant spot market). For each proposal, the proposer needs to deposit a minimum of 1 INJ to create the proposal and 500 INJ to vote.

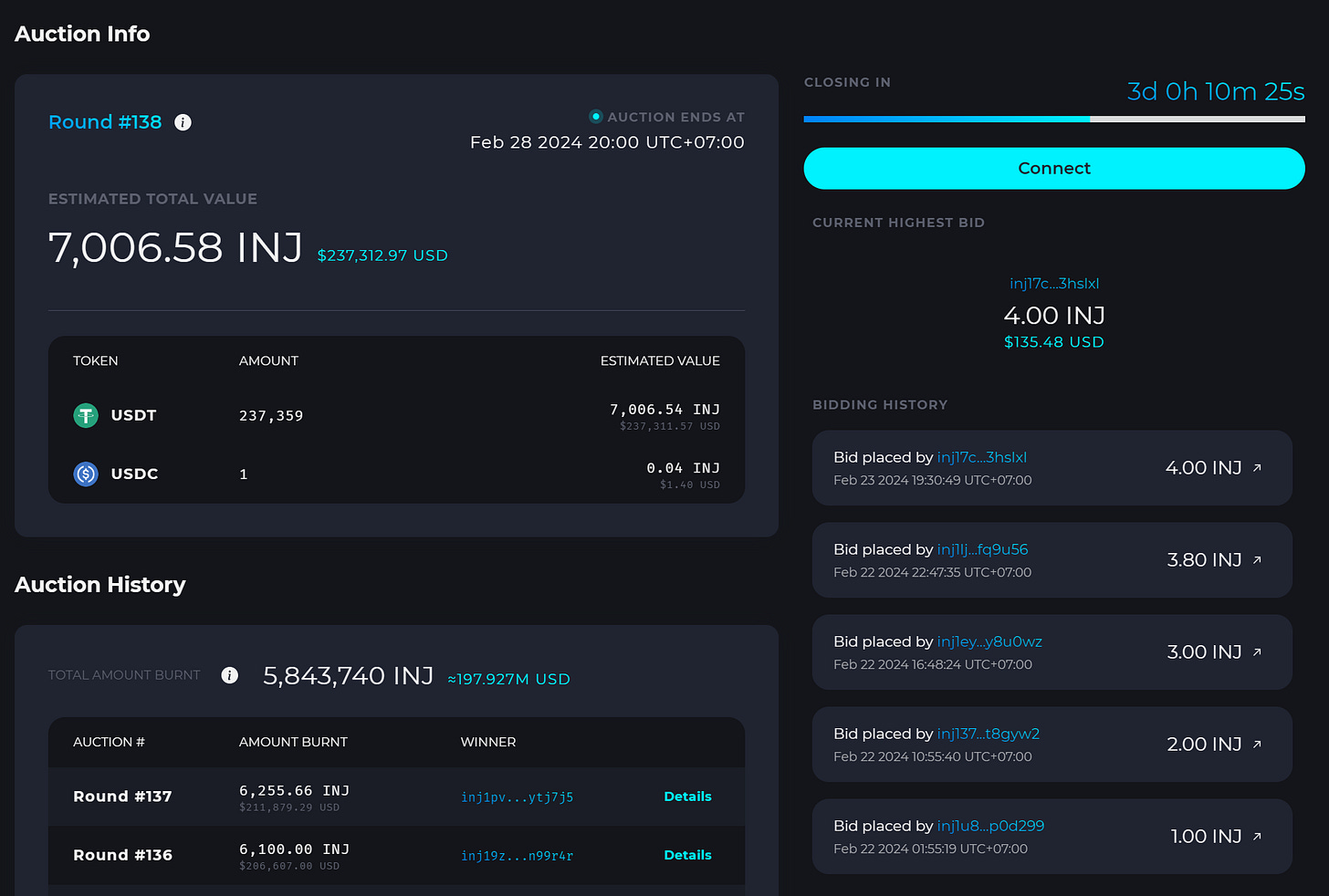

2.5. Auction

Injective Auction is a weekly event where community members can use their INJ tokens to auction transaction fees. At the end of each auction session, the winning bidder receives all assets from the auction, and the amount of INJ they used to win the auction is burned, helping reduce the circulating supply of INJ tokens.

You can find more information on how to participate in the auction on Injective's official website.

2.6. Insurance Funds

Injective's Insurance Funds are used to protect derivative markets on the platform. Anyone can propose the establishment of a new fund or participate as a guarantor for the fund. To propose a new fund, users will need a minimum of 20,000 USDT.

2.7. Ninja Pass

Injective Ninja Pass is a special card that provides users with early access to products, events, airdrops, and exclusive gifts from the Injective ecosystem. Each Ninja Pass will have a unique code and be randomly distributed to users.

If you do not already own a Ninja Pass, you can register your email address on the Ninja Pass website to receive the latest updates.

Additionally, through trading competitions, events on X (Twitter), and other activities, each decentralized application (DApp) within the Injective ecosystem will organize separate campaigns to distribute Ninja Passes. You can follow projects on Injective to seek opportunities to receive Ninja Passes.

3. Where does Injective's revenue come from?

Injective's revenue primarily comes from transaction fees generated from auction activities on the platform. Injective specifically retains 60% of the total transaction fees paid by users (the remaining 40% goes to exchanges built on Injective).

Transaction fees are calculated based on the following formula:

Fee = Gas x Gas Price

Therefore, the total fee that a user has to pay for a transaction depends on both the amount of gas consumed by that transaction and the gas price set by the user.

4. The highlights of Injective

Injective is a unique blockchain platform with several standout features. Firstly, Injective is not just a regular exchange but a comprehensive blockchain platform, following a 'One-size-fits-all' approach, meaning it can support all types of applications and services.

Injective is part of the Cosmos ecosystem, and after successful integration with Inter-Blockchain Communication (IBC), this platform can interact and exchange information with other blockchains within the Cosmos ecosystem, including Akash, Osmosis, and more. The platform operates based on the Proof of Stake mechanism, is free from Front-run, and can connect to Ethereum through the Peggy Bridge, a bridge allowing asset movement between Ethereum and Injective Chain.

Injective is also an ideal platform for developers to build DApps and leverage resources on the platform. Injective supports nodes of the Injective Chain, bridge smart contracts, and grants power to Validators. Developers can build dApps and DeFi products requiring cross-chain liquidity, such as decentralized exchanges (DEX) with orderbook, derivatives/spot, and more.

Injective also has several incentive mechanisms to encourage developers to create new DApps/products that benefit the community. Notably, insurance funds, auctions, and staking. Additionally, Injective does not restrict access to various liquidity pools, facilitating the creation and development of new projects.

5. INJ Token Details

5.1. INJ token key metrics

Token Name: Injective

Ticker: INJ

Blockchain: Ethereum, BNB Chain, Injective

Token Standard: ERC-20, BEP20

Contract: Ethereum: 0xe28b3b32b6c345a34ff64674606124dd5aceca30BNB Chain: 0xa2b726b1145a4773f68593cf171187d8ebe4d495

Token type: Utility, Governance

Total Supply: 100,000,000 INJ

Circulating Supply: 80,005,555 INJ

5.2. INJ Token Allocation

Ecosystem Development: 36.3% (equivalent to 36,330,000 INJ)

Team: 20% (equivalent to 20,000,000 INJ)

Private Sale: 17% (equivalent to 17,000,000 INJ)

Community Growth: 10% (equivalent to 10,000,000 INJ)

Binance Launchpad: 9% (equivalent to 9,000,000 INJ)

Seed Sale: 6% (equivalent to 6,000,000 INJ)

Advisors: 2% (equivalent to 2,000,000 INJ)

5.3. INJ token use cases

INJ is the primary token and governance token of Injective, with the following applications:

Governance: INJ holders can participate in Injective's governance by making proposals and voting on decisions such as auctions, modules, Cosmos SDK, etc. Each INJ token represents one vote, and the more INJ you own, the more voting power you have.

Accumulating transaction fee value: A portion of the transaction fees collected on the platform after rewarding relayers is used to repurchase and burn tokens (buy-back-and-burn), aiming to increase the value of the INJ Token.

Margin collateral for derivative markets: INJ is used as collateral and margin assets for derivative markets on Injective. INJ can also be staked in insurance funds and earn interest in certain future markets.

Encouraging dApps on the exchange: INJ is rewarded to DApp developers within the Injective ecosystem.

Staking rewards (Network security): Injective incentivizes nodes staking INJ to participate in the security process of the Injective network and receive rewards in the form of INJ tokens.

5.4. INJ token release schedule

The INJ token allocation schedule is designed to ensure the stability and sustainability of the Injective ecosystem. You can track the vesting schedule on platforms such as Token unlocks, Cryptorank...

5.5. Where can I buy INJ tokens?

INJ, the native coin of Injective, can be purchased through centralized exchanges (CEX) such as Binance, BingX, Pionex, and decentralized exchanges (DEX) such as Uniswap, SushiSwap.

5.6. Storage wallets for INJ tokens

Regarding the storage of INJ Tokens, users can choose any wallet that supports the Ethereum and BNB Chain networks. Some reputable wallets include Rabby, Metamask, Ledger, and Trezor.

6. Injective Roadmap and Updates

Injective has been launched since 2018 and has undergone several significant updates in its development roadmap. Here is the Injective roadmap for 2023:

Q1/2023: Launch of Injective Hub V2, Institutional Zone.

Q2/2023: Deployment of Injective Exchange Module V2, Casablanca upgrade.

Q3/2023: Injective Orbital Chains.

Q4/2023: Mesh Chain network, Carcosa upgrade.

Q5/2023: Introduction of multi VM chain.

7. Project Team and Investors of Injective Project

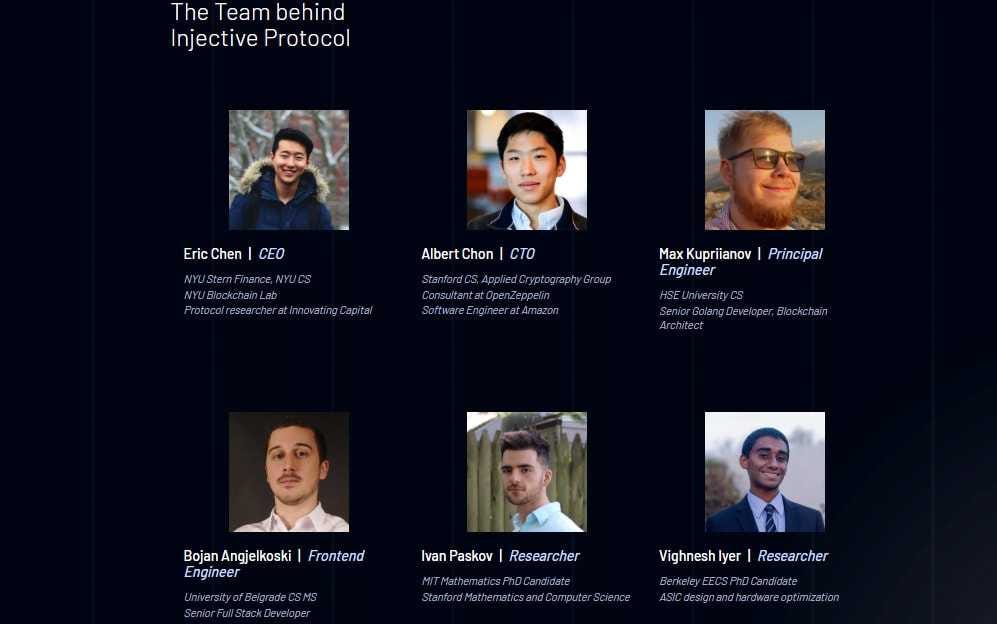

7.1. Project team

The team comprises experienced members who have worked at major software companies such as Amazon. The CEO and co-founder of Injective is Eric Chen and the CTO and co-founder is Albert Chon. Other core team members include Max Kupriianov, Bojan Angjelkoski, Ivan Paskov, Vighnesh Iyer...

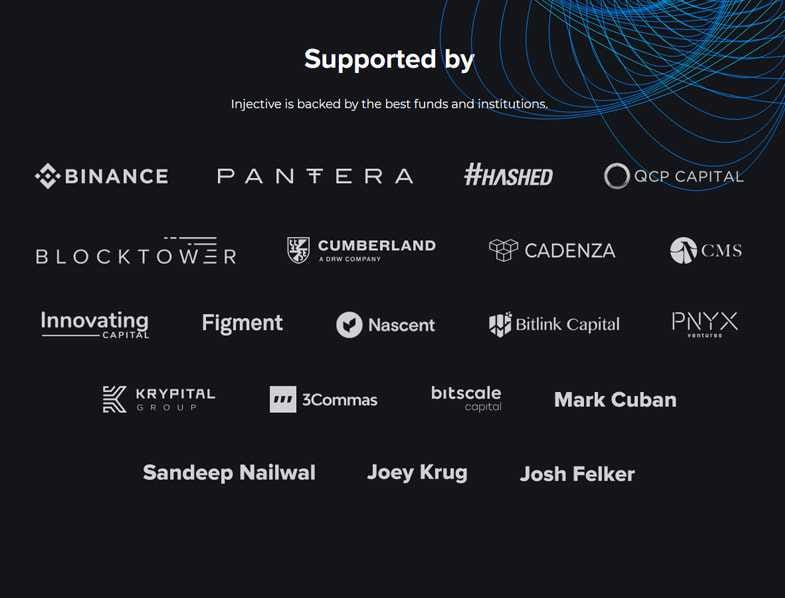

7.2. Investors

Injective has raised a total of $56.7 million through 5 funding rounds, with the participation of renowned investors such as Mark Cuban and many other reputable investment funds including Binance Labs, Pantera Capital, BlockTower, Hashed Ventures, CMS Holdings, Jump Crypto, and QCP Capital.

On January 15, 2023, Injective announced the launch of the Venture Group - a $150 million investment fund dedicated to projects developing on the Injective ecosystem. This fund includes participation from major organizations including Pantera Capital, Kucoin Ventures, Jump Crypto, IDG Capital, Gate Labs, Delphi Labs, Flow Traders and Kraken Ventures.

7.3. Partners

Following the announcement of the ecosystem development fund, Injective has partnered with various entities, such as:

Blockchain layer 1: BNB Chain, CosmosHub, Kardian Chain, Cartesi, Burnt, Canto, Chiliz…

Wallet: Metamask, Keplr, Ledger, Trezor…

Validators: Chorus One, Cosmostation, DSRV, Helios Staking, Notional, AUDIT.one…

Data: Pyth, API3, Band Protocol, Chainlink, DIA, NFTBank, UMA…

Metaverse: Axie Infinity, Bored Ape Yacht Club.

8. Closing thoughts

Injective Protocol is a unique and innovative blockchain platform, offering numerous features and benefits. It is not just an ordinary trading platform but also a comprehensive blockchain supporting all types of applications and services.

What about your thoughts? If you want to know further about it, don’t hesitate to share it with us! 😀

This post is for educational purposes only. All materials I used were the different reference sources. Hope you like and follow us and feel free to reach out to us if there is an exchange of information. Cheers! 🍻

#InjectiveProtocol #INJ #BinanceLaunchpad