What is Market Cap in Cryptocurrency? And how to calculate?

Market cap, or market capitalization, is the market value of a specific cryptocurrency. In other words, it shows how much a crypto asset or the company behind it is worth.

Hello everyone, besides Bitcoin Halving, we will find out another term that we should know, it’s Market Cap.

Market Cap is a common term, not only in Cryptocurrency but also in other markets such as stocks. Understanding the definition of Market capitalization can help you know more about the market and you can make better investment decisions. I’m Neo — Admin — Community Manager of Optimus Finance and Growth Marketing of LECLE Vietnam. Let’s get started to dive into it!

1. What is market cap?

Market cap, or market capitalization, is the market value of a specific cryptocurrency. In other words, it shows how much a crypto asset or the company behind it is worth.

Fully Diluted Valuation (FDV) is the market capitalization of a cryptocurrency if its maximum token supply is reached. FDV will show how much a crypto asset or the company behind it is worth considering all tokens are released onto the market, rather than considering only its circulating tokens.

Market cap or FDV can be used to evaluate and compare the value of one crypto asset to another. This is the simplest and most basic way to check whether a crypto token is undervalued, overvalued, or correctly valued.

If all tokens of a cryptocurrency are released and no tokens are burned (removed from circulation), its market cap will be equal to its FDV.

Sometimes you will see some projects, that have an unlimited max supply like

Optimus Finance, Ethereum,…

2. How to calculate market cap

Market cap is calculated by multiplying the number of tokens in circulation by the token’s current price, while Fully Diluted Valuation is calculated by multiplying the maximum number of tokens by the token’s current price.

Market Cap = Current Price x Circulating SupplyFDV = Current Price x Max Supply

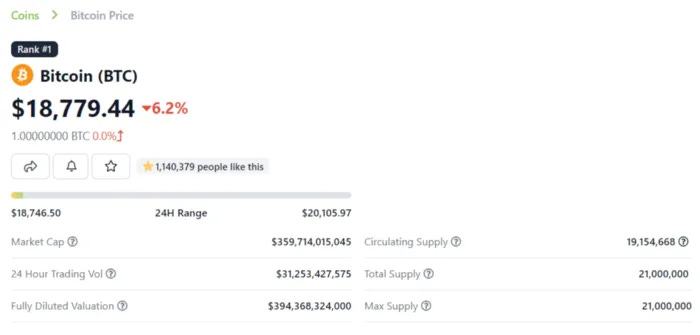

For instance, let’s take Bitcoin (BTC). At the time of writing:

The price of Bitcoin (BTC): $18,779.44The circulating supply of Bitcoin (BTC): 19,154,668The maximum supply of Bitcoin (BTC): 21,000,000We can calculate by those formulas:

The market cap of Bitcoin (BTC) = $18,779.44 * 19,154,668 = $359,713,938,425.92The FDV of Bitcoin (BTC) = $18,779.44 * 21,000,000 = $394,368,240,000

3. Why market cap is more important than price?

Market cap is a number that determines the current market value of a cryptocurrency, not its price. You can evaluate the value of a crypto asset by looking at its market cap rather than its price since the number of tokens between each cryptocurrency varies.

For example, the price of Cardano (ADA) is currently $0.442755, while that of Polkadot (DOT) is currently $6.32. However, there is approximately 33,8B ADA in circulation, making its market cap $14,9B, while there is only 1.1B DOT, meaning Polkadot’s market cap is only $7,2B (CoinGecko — updated Sep 19th, 2022).

We will see that if we look at the price, ADA is much cheaper than DOT. Nevertheless, this does not necessarily mean the value of Cardano is lower than Polkadot. In fact, regarding market cap, Cardano is more valuable than Polkadot.

Every cryptocurrency has a different set of circulating supply and max supply. Because of this, we can not evaluate a cryptocurrency based on its price and have to evaluate its market cap. That is the reason why the market cap is such a useful tool for any crypto investor.

On the other hand, Fully Diluted Valuation (FDV) can also be used similarly to market cap. This really depends on the investor’s choice: someone prefers to calculate the valuation of a cryptocurrency using its market cap (current value), while others favor FDV (possible future value).

4. Sizes of market cap

According to the market cap, cryptocurrency can be divided into 3 main categories: Large-cap, mid-cap and small-cap (low-cap).

Actually, we can’t describe the definition what is large-cap, mid-cap and small-cap. Everyone will have their own definition.

Personally, I will define them in a way that we think is the most appropriate.

4.1. Large-cap

Large-cap cryptocurrencies are the ones that have a market cap of over $1B. At the moment, there are 53 large-cap cryptocurrencies, with Bitcoin (BTC) on top with a market cap of $360B (CoinGecko updated Sep 19th, 2022)

Large-cap cryptocurrencies will be more stable in price and have higher liquidity but less possible growth.

4.2. Mid-cap

Mid-cap cryptocurrencies are the ones that have a market cap from $100M to $1B. Most investors will make investments in this category because they can increase the price with medium risk. The liquidity of these cryptocurrencies is also enough for most types of investors and traders.

4.3. Small-cap and low/cap

Small-cap or low-cap cryptocurrencies are the ones that have a market cap of below $100M. These are often newcomers to this market and are only developing in the early stages. Therefore, investing in such tokens can return exponential profits.

Nevertheless, the risk of them also gets much higher: such cryptocurrencies can die out in no time. At the same time, the liquidity of these cryptocurrencies is also extremely limited, making it difficult for them to be traded. Price slippage can occur easily.

Most frauds/scams are in this category, so you should consider it carefully before putting your money in this type of crypto asset.

5. Top market cap cryptocurrencies

At the moment of this article, the top 10 cryptocurrencies with the highest market cap are Bitcoin (BTC), Ethereum (ETH), Tether (USDT), USD Coin (USDC), BNB (BNB), Binance USD (BUSD), XRP (XRP), Cardano (ADA), Solana (SOL) and Dogecoin (DOGE).

You can use CoinGecko or Coinmarketcap to check the statistics.

6. Is it good to have a big market cap?

The bigger the market cap, the more valuable a cryptocurrency is. To gain a large market cap or become a large-cap cryptocurrency, we have to prove a variety of things: worthiness, applicability,… Therefore, a big market cap is a great achievement for a crypto asset.

7. What if the market cap is zero?

If the market cap is zero, there are 3 possible cases: the token price becomes 0 (the project no longer operates or becomes worthless), the project migrated to a new token (the old token becomes irrelevant), or the project has not released any tokens.

8. Closing thoughts

Market cap, or market capitalization, is the market value of a specific cryptocurrency. Personally, the market cap is an incredibly useful tool for us because it helps them correctly evaluate the value of a cryptocurrency in a simple way.

What about your thoughts? Don’t hesitate to share with us! 😀

This post is for educational purposes only. All materials I used were the different reference sources. Hope you like and follow us and feel free to reach out to us if there is an exchange of information. Cheers! 🍻

#marketcap #crypto #blockchain