Understanding the tokenomics. Why is it important?

Tokenomics is a term that captures a token’s economics, consisting of two words: Token and Economics.

Hello everyone,

Tokenomics is one of the most popular terms when joining crypto investment, but not everyone understands it thoroughly and why it matters.

I think that the phrase seems theoretically simple at first look but the deeper you dive in, the more complicated it becomes. If tokenomic has a problem, the project will be hard to survive in the long term.

I'm Neo — Admin — Community Manager of Optimus Finance and Growth Marketing of LECLE Vietnam. Today, I’d like to introduce you to insightful information on Tokenomics. Let’s begin, now.

1. What is Tokenomics?

Tokenomics is a term that captures a token’s economics, consisting of two words: Token and Economics.

Therefore, the word Tokenomics can be defined as the tokenized version of economics, or how crypto tokens can be developed and applied to the economy of a project. Aside from looking at the white paper, founding team, roadmap, and community growth, tokenomics is central to evaluating the future prospects of a blockchain project. Crypto projects should carefully design their tokenomics to ensure sustainable long-term development.

Well-designed tokenomics is critical to success. Assessing a project’s tokenomics before deciding to participate is essential for investors and stakeholders.

2. The components of a Tokenomics

2.1 . Coin/Token Supply

Before, Total Supply and Circulating Supply are the two frequently used definitions. I introduced and explained further with visual illustrations so that you understand these phrases more easily in What is Market Cap in Cryptocurrency? And how to calculate? article.

In this article, I will explain it more.

2.1.1. Total Supply

is defined as the total number of the circulating tokens plus the locked tokens, minus the burned tokens. The total supply is initially determined by the developer team so that it can suit the project perfectly.

To be more specific, there are 2 types of Total Supply:

Fixed Total Supply: The Total Supply is predetermined and cannot be changed. For example: The Total Supply of Bitcoin is 21 million BTC,…

Unfixed Total Supply: The Total Supply can be changed depending on the project features, which can be further divided into:

The Total Supply increases due to mining. For example: ETH is mined corresponding to the Ethereum Network’s performance, FIN (Optimus Finance),…with no limited Max Supply.

The Total Supply decreases due to burning. For example: The initial Total Supply of Binance Coin was 200 million BNB, which has been burned nearly 50 million BNB over time,… we can check it here for BNBBurn.

The Total Supply constantly changes due to the Mint and Burn model. For example: The Total Supply of stablecoins, such as Algorithmic Stablecoin (FEI, AMPL,…), Crypto-backed Stablecoin (DAI,VAI,…), Centralized Stablecoin (USDT, USDC,…).

2.1.2. Circulating Supply

is defined as the total number of tradable tokens circulating in the market.

2.1.3. Max Supply

is defined as the total number of tokens that can possibly be reached in the future.

2.1.4. Analyze Token Supply

Here are the Token Supply metrics of 3 different coins/tokens:

ETH: Ethereum has no Max Supply and will only be minted when there exists the demand of using the Ethereum Network. After being minted, ETH will circulate without being locked by any parties (Circulating Supply = Total Supply).

SRM: Serum was designed with the Max Supply of 10 Billion SRM. At the moment, the number of SRM can only reach 161 million SRM (Total Supply), however, only 50 million SRM are currently circulating in the market (Circulating Supply).

NEAR: The Token Supply of Near Protocol is the most basic and most frequently seen. Initially, the Max Supply = the Total Supply and NEAR tokens will be unlocked until the 1 Billion NEAR is reached (Circulating Supply).

2.2. Market Cap & Fully Diluted Valuation

In this part, you can visit this article for more detail What is Market Cap in Cryptocurrency? And how to calculate?

2.3. Token Governance

At the moment of this article, there are more than 10,000 coins and tokens. However, not every token follows the Decentralized model as Bitcoin and there will be a number of coins/tokens that are governed by the Centralized model. I will filter the tokens into basic types:

Decentralized: Decentralized tokens are completely governed by the community and do not attach to any organizations. For example: Bitcoin, Ethereum,…

Centralized: Centralized tokens are governed by a leading organization who have full control over the token metrics and its underlying project. Usually, this is the case of Full-backed stablecoin projects such as Tether, TrueUSDm,… or Centralized Exchanges such as Huobi, FTX,…

From Centralized to Decentralized: There are still some coins/tokens that were originally centralized, but their governance power was later delegated to the community.

For example: At first, Binance Coin was totally governed by Binance. However, a while after the launch of BNBChain — Binance Smart Chain (formerly) and the “Validator Spotlight” program, Binance gradually decentralized the BNB network and the BNB token, which gave users the governance rights.

2.4. Token Allocation

Before investing in any token, it is imperative that you look over its Token Allocation — an important tool that shows you how the tokens are distributed among Stakeholders, whether that distribution is reasonable, and how it can influence the project.

A successful token should be backed by strong utility cases which are core to the project, and encourage investors’ participation in the utilities and governance of the project.

2.4.1. Team

This is the allocation reserved for the project’s developer team, which includes constructive contributors like founders, developers, marketers, advisors,… An ideal portion would be about 20% of the Total Supply.

If the allocation is too small, the team will have no motivation to develop the project in the long run.

If the allocation is too huge, the community will have no motivation to hold the tokens since they are overwhelmingly manipulated by one party. The team will have the full ability to govern the protocol in a centralized manner, or navigate the token’s price at their will.

2.4.2. Foundation Reserve

This reserve will be used to develop the project or its products in the future. There is no specific standard for this part, which normally accounts for 20–40% of the Total Supply.

2.4.3. Liquidity Mining

The allocation for Liquidity Mining has appeared a lot recently, especially since the tremendous DeFi trend from September 2020. The tokens allocated for this section are minted as incentives for Liquidity Providers across multiple DeFi protocols, which normally accounts for 10% of the Total Supply.

2.4.4. Seed Sale/Private Sale/Public Sale

The tokens saved for this portion are used in fundraising events, which commonly comprise the Seed sale, the Private Sale, and the Public Sale. IDO/IEO: IDO usually takes 1–2%, depending on the project’s plan and IDO platform requirements.

2.4.5. Airdrop/Retroactive

In order to attract early adopters, projects often airdrop a small number of tokens (usually 1–2% of the Total Supply) to users.

Before 2019, the requirements to participate in an Airdrop were just simple actions such as Like, Follow, Retweet the project’s posts on Twitter.

Nevertheless, since 2020, joining in an Airdrop has required much harder objectives, forcing users to “skin in the game”, directly use and interact with the products to receive Airdrop or Retroactive rewards like Uniswap, 1 inch Network,...

2.4.6. Other Allocation

This allocation can be flexibly adjusted depending on each project, and whether it is used for Marketing, Strategic Partnership, or any other expenses. Naturally, this portion only accounts for a small percentage of the Total Supply.

Marketing: usually around 10%

Partnerships/Ecosystem: to incentivize developers/projects integration, partnerships and community participants, 10–20%

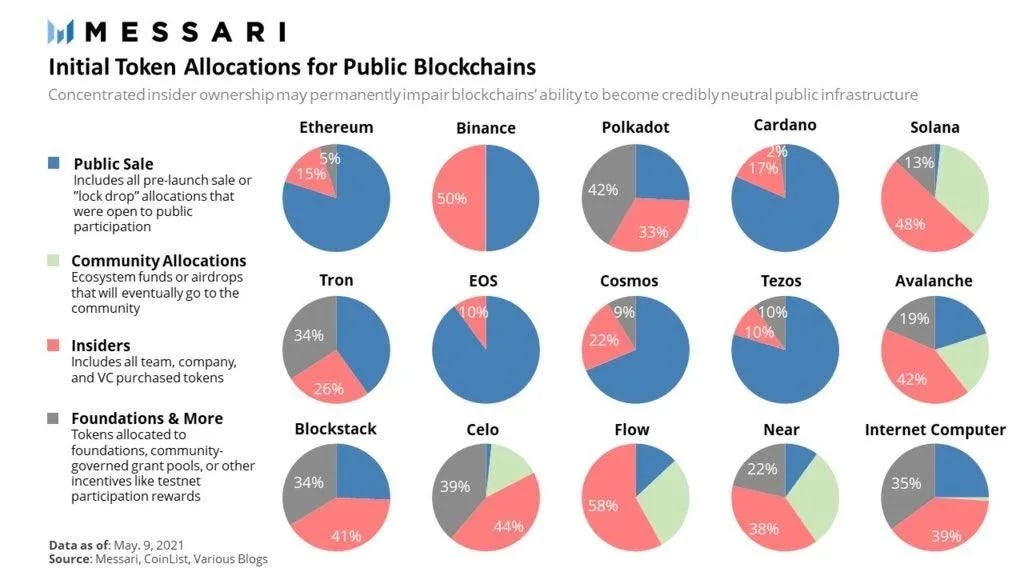

We can notice the difference between 2 different periods:

2017–2018: Publics Sale accounts for more than 50%, Insiders accounts for less. For instance: ADA, ETH, XTZ, ATOM, ICX…

From 2019: Public Sale accounts for 20–30%, Insiders accounts for the highest portion. For instance: NEAR, AVAX, SOL,…

Whereas:

The Public Sale allocation is exposed to the community.

The Insiders allocation is exposed only to the team, backers,…

The crypto market has witnessed the appearances of numerous Venture Capitals (VCs) and the tokens have been available on different blockchain platforms, which explains why the Insiders and the Foundation now hold the majority of the tokens.

2.5. Token Release

Token Release is the plan to distribute the tokens into circulation. Similar to Token Allocation, Token Release has a huge impact on the token’s price as well as the community’s motivation to hold the tokens. There are 2 types of Token Release at the moment:

2.5.1. Release tokens on schedule

Although the Token Release schedule varies between different protocols, it can be split into 3 types:

Under 1 year: Projects releasing 100% tokens in 1 year or less show that their developers and team are not dedicated, and they are not willing to create any long-term value for the project.

From 3–5 years: This is an ideal timeframe to fully release the tokens, as the crypto market is changing at a rapid pace. Counted from 2017 — the time when it started to be “Mainstream”, the crypto market is now only 5 years old.

After each year, the market has eliminated a variety of inefficient projects, at the same time maintaining the productive ones. That is why 3–5 years is such a perfect number, as it stimulates not only the team’s motivation to grow, but also the community’s motivation to continuously support the project.

Over 10 years: Except Bitcoin, every project that produces a 10 year or more Token Release schedule will have difficulty in motivating either developers or holders, since they have to undergo the token’s inflation for over 10 years. It is uncertain that the team can productively grow the project for such a long time.

To conclude, the Token Release needs to be designed in a way that satisfies 2 core elements:

The benefits of token holders.

The tokens’ value when they are released (inflation). Inflation: the incremental change month-on-month should be well controlled, minding the different pools. Make sure the token unlocked will be enough to cover company expenses.

If the tokens are released faster than the product’s work rate, their price will decline due to inflation and token holders will lose interest.

2.5.2. Release tokens on demand

To deal with the possible inflation, some projects decide to release tokens on a flexible standard instead of a specific timeframe. This will help the projects make necessary adjustments according to the situation.

For example: MakerDAO does not have a specific Token Release schedule. Depending on the practical demand on the platform, the number of MKR tokens will be modified reasonably such that MKR tokens are only released when there are Lending/Borrowing activities.

2.6. Token Sale

Token Sale can be considered similar to the fundraising events in traditional markets, whereas companies raise funds by selling their shares.

In the crypto market, the shares will be replaced with tokens.

While traditional companies usually hold 5 fundraising rounds, crypto projects only have 3. The business valuation can vary between disparate sectors, areas and scales. However, it is a common belief that in the Series C, promising companies can be valued at more than $100 million.

Traditional Companies: Pre-seed, Seed, Series A, Series B, Series C.

Crypto Project: Seed, Private Sale, Public Sale.

The average business valuation in the crypto market is lower because this market is fairly new, and its Market Cap is still much smaller than that of the stock markets in developed countries.

2.6.1. Seed sale

Seed sale is the first Token Sale of a project. In this round, the product of most projects are still under development. The seed sale can be regarded as the initial fundraise for some projects to start.

Most Venture capitals (VCs) participating in seed sales accept a high risk investment. In return, they can potentially receive high rewards if the project succeeds.

2.6.2. Private sale

If the participants in the seed sale are mostly risk-taking capitals, the private sale witnesses the appearance of bigger and more famous ones. Most projects in this round have introduced their products and proved their potential after the seed sale.

2.6.3. Public sale

Public sale is the fundraising round for the community. The projects can launch tokens in the form of ICO as in 2017, or through a third-party in the form of IEO or IDO.

2.6.4. Fair token distribution

However, some projects do not organize any Token Sale rounds, but rather distribute their tokens through Testnet, Airdrop, Staking, Liquidity Providing,… In this way, the project becomes more “fair” in the eyes of the community, therefore becomes more accessible by public users.

Some famous Fair-launch projects are Optimus Finance (FIN), Yearn Finance (YFI),… They did not raise funds by any means; instead, they distributed their tokens to the actual users and supporters.

Some Advantages and Disadvantages of this model:

Advantages: Tokens are fairly distributed to the valuable contributors of the project, ameliorating the situation of seed sale & private sale investors “dumping” tokens.

Disadvantages: The project may perhaps “miss” a portion of the funds that can be used to develop the products.

2.7. Token Use Case

The Token Use Case is the applications and purposes of that token. It is the most important factor of Tokenomics, which indicates how a token can be used and how much its price should be based on the benefits it brings to token holders.

Tokens are commonly used for:

2.7.1. Staking

Most projects support Staking with their native token, which incentivizes more token holders as they can earn extra tokens with Staking.

Staking requires users to lock their tokens inside the protocol, reducing the number of circulating tokens on the market, therefore positively affecting the price of that token. With networks using the Proof-of-Stake (PoS) mechanism, the network becomes safer and more decentralized as the number of staked tokens increases.

2.7.2. Liquidity Mining (Farming)

Users can provide liquidity in DeFi protocols to receive the project’s native token as a reward.

For example: Provide liquidity for Uniswap to receive UNI,…

2.7.3. Transaction fee

To perform a transaction, users have to pay a small amount of transaction fee to the Validators who are confirming your transaction. Each blockchain uses a separate native token as payment for the transaction fee (usually blockchain platform projects). For example:

Ethereum uses ETH.

BNB Chain uses BNB.

ICON Network uses ICX.

Polygon uses MATIC.

2.7.4. Governance

As mentioned above, the platform can be either Centralized or Decentralized, depending on the project’s decision. That being said, most DeFi protocols now follow the Decentralized governance model.

As a result, token holders have the right to propose ideas and vote on the platform. The suggestions can be related to transaction fee, Token Release schedule, or more serious problems such as expanding the project to another blockchain.

2.7.5. Other benefits (Launchpad,…)

Some projects have recently complemented the Launchpad feature into their products, which requires users to stake their tokens to participate in Token Sale events on the platform, or in lottery events to receive NFT,…

For example: Polkastarter requires users to stake POLs, DAO Maker requires users to stake DAOs,…

3. Tokenomic Case Studies

These are only personal viewpoints, and should not be considered financial advice under any circumstances.

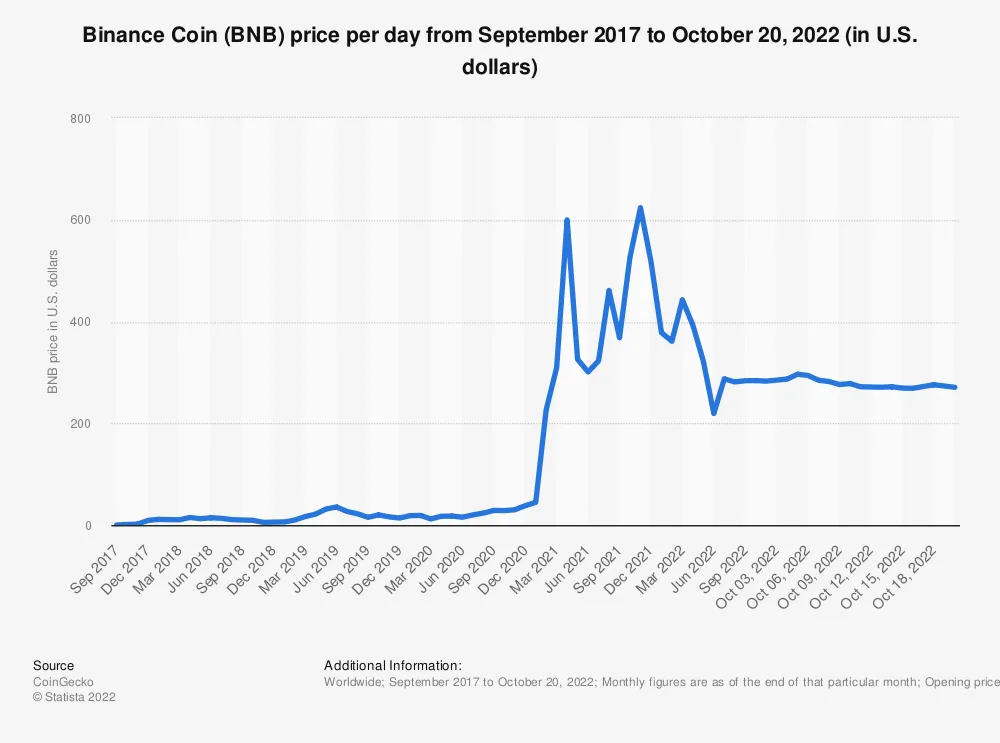

Binance Coin (BNB)

Token Supply

Initial Total Supply: 200,000,000 BNB.

Token Release schedule: 5 years (now 100% unlocked).

The token burning mechanism is applied until the Circulating Supply becomes 100,000,000 BNB.

⇒ Deflationary, create motivations for the token price to increase and for BNB holders to believe in the project.

Token Use Case

Nonetheless, Token Supply is not the main reason for BNB’s tremendous growth lately, but rather how BNB tokens were designed to be used on both Binance Exchange and the BNB chain.

Binance Exchange: Reduce transaction fee, participate in Launchpad, Staking, Lending & Borrowing, Derivatives,…

BNB Chain: Native token, pay network costs, stake and farm (using BNB as the indispensable token when creating a liquidity pair, a similar situation as ETH on Ethereum, which is the key leading to BNB’s growth).

Binance is also developing Binance Pay, which can lead to BNB becoming one of the most popular payment currencies if Binance Pay succeeds in the future.

The result: The BNB price went sideways at $20 until it dramatically increased to an ATH of $650 (+3,250%) and now remains at approximately $300 (+1,500%).

4. Viewpoints on the Case Studies

As mentioned above, the Tokenomics design is not attached to anything. Depending on the product model and the sector that the project aims towards, the team can adjust the Tokenomics accordingly and appropriately.

Evaluating a token is not only about analyzing its applications, but also about investigating its target market.

How massive is that market segment? How many users are there? Is the Tokenomics design balanced between its applications to the project and its benefits for token holders?

5. What’s next for tokenomics

Since the genesis block of the Bitcoin network was created in 2009, tokenomics has evolved significantly. Developers have explored many different tokenomics models. There have been successes and failures. Bitcoin’s tokenomics model still remains enduring, having stood up to the test of time. Others with poor tokenomics designs have faltered.

Non-fungible tokens (NFTs) provide a different tokenomics model based on digital scarcity. The tokenization of traditional assets such as real estate and artworks could generate new innovations in tokenomics in the future.

6. Closing thoughts

Tokenomics is a fundamental concept to understand if you want to get into crypto. It’s a term capturing the major factors affecting the value of a token. It’s important to note that no single factor provides a magical key.

Your assessment should be based on as many factors as possible and analyzed as a whole. Tokenomics can be combined with other fundamental analysis tools to make an informed judgment on a project’s future prospects and its token’s price.

Finally, the economics of a token will have a major impact on how it is used, how easy it will be to build up a network, and whether there will be much interest in the use case of the token.

I hope it has helped you in gaining more valuable insights into this sector, including its components and meanings. What about your thoughts? If you want to know further about cryptocurrency, don’t hesitate to share with us! 😀

This post is for educational purposes only. All materials I used were the different reference sources. Hope you like and follow us and feel free to reach out to us if there is an exchange of information. Cheers! 🍻

#cryptocurrency #tokenomics #blockchain